What Lies Ahead for the Japanese Market?

Advertisements

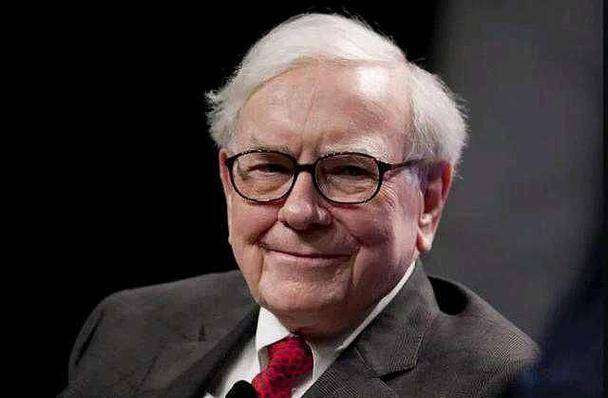

The recent turmoil in global stock markets has been particularly notable in Japan, where investors found themselves grappling with significant declines. Rumors spread over the weekend about Warren Buffett's decision to sell off his stake in Apple, triggering widespread panic that resulted in a sharp drop in Japanese stocks. This occurrence points to the underlying fears surrounding the risk of economic recession in the United States and the deep-seated anxieties regarding Japan’s economic and financial dependence on America.

Buffett’s actions were not without consequence. In August 2020, when Buffett first disclosed his holdings in Japan's stock market, the average stock price of the five major trading companies experienced a striking increase, nearly quadrupling in value. This instances showcased the immense influence Buffett has in global markets. However, his recent move to divest from Apple has shaken investor confidence globally. The backdrop of disappointing economic data from the U.S. and increasing fears that retail investors could flee the market also amplified the ramifications of Buffett's decision.

According to seasoned analyst Jesper Koll, Buffett's actions seem to convey a strong message: with the likelihood of a U.S. economic downturn rising sharply, the cycle of dollar appreciation is nearing its end. He suggested that the Japanese market should not resist this economic cycle but instead brace for potentially cheaper entry points in the future. This perspective stirred significant reactions within the Japanese market, prompting investors to sell off in waves and contributing to a severe market downturn.

The market's reaction was swift and brutal. On that fateful Monday, the global financial stage was engulfed in chaos, characterized by a massive sell-off across various markets. Notably, Japan's Nikkei 225 index and the Tokyo Stock Exchange Index both plummeted nearly 12% in value. This staggering drop shattered previous records, marking the most significant single-day decline since 1987. The spread of panic amongst investors acted like a contagious disease, accelerating already frantic sell-offs among retail investors. Many were left with no choice but to sell stocks bought on margin, exacerbating the downward spiral as they faced forced liquidations.

Several interconnected factors fueled this panic sale. First and foremost was the revelation of weakened economic data. Data indicated that expectations for robust U.S. economic performance over the next year had plummeted to its lowest in seven months. Additionally, disappointing non-farm payroll figures only amplified concerns regarding a possible recession. As fears grew, speculation regarding a Federal Reserve rate cut in September also intensified, further dampening market sentiment.

Moreover, as the United States prepared for a potential shift towards lower interest rates, the Bank of Japan remarkably decided to raise interest rates, which only cascaded fear through the markets. The convergence of these factors thrust the Japanese stock market into a state of disarray, leading to unprecedented volatility.

Buffett's drastic maneuver, such as drastically reducing his stake in Apple while beefing up his cash reserves to a historic high of nearly $200 billion, conveyed a stark message to investors. This move signified a belief that cheaper entry points in the market might be on the horizon. Yet, rather than instilling confidence, this decision fueled an already-heightened sense of panic across the marketplace.

The implications of Buffett’s strategy were profound, serving as a warning about future economic conditions, particularly as concerns regarding the U.S. economy permeated the Japanese market. Investors responded to this apprehension by quickly divesting their shares, which in turn led to a steep decline across the stock market.

Looking ahead, the Japanese market is currently navigating a treacherous landscape filled with myriad challenges. The interdependence on the U.S. economy means that shifts there can cascade into Japan, creating significant uncertainties here. Market sentiment among retail investors remains fragile, with the fear-induced sell-offs showing little signs of abating in the short term.

One of the principal hurdles Japan faces is its economic reliance on America, which leaves it vulnerable to global economic fluctuations. The fear surrounding U.S. economic instability can easily bleed into Japanese markets, affecting investor confidence. Further complicating this situation is the behavioral response of retail investors, who are often swayed by market sentiment. With alarming signs of distress in the market, a mass sell-off creates an atmosphere of panic that can be difficult to reverse.

Additionally, the potential policy shifts by both the Fed and the Bank of Japan will continue to wield significant influence over market behavior. Investors are urged to stay vigilant, monitoring geopolitical and economic dynamics that could affect their strategies. The delicate balance between expectations surrounding U.S. monetary policy and changes from Japan's central banks remains a vital point of observation.

As we navigate this intricate landscape, it is clear that Japan’s markets may remain on a turbulent path, influenced heavily by global economic conditions and policy adjustments. Investors should prepare to recalibrate their strategies amid ongoing uncertainty, being mindful of the broader implications from fluctuating economic data and market sentiment.

In conclusion, the tremors felt in the market following Buffett’s significant decision not only reflect immediate investor apprehension but also expose deeper economic vulnerabilities tied to the U.S. economy. Japan's dependence on the American financial system means that it is bound to endure substantial uncertainties. Thus, investors must stay attuned to the evolving market environment and engage in prudent adjustments to their investment approaches in response to potential volatility.